倒産確率推定の話②

アプローチ②:オプション・アプローチ

森平(2000)*1を主に参考にして勉強しました。将来資産が将来負債額を下回る「確率」を推定する、とざっくり捉えてます。これが、コールオプションの価格決定理論に基づいているため「オプション・アプローチ」と呼ばれたりします。同論文では以下において、は所与の値で、

をガウス・ザイデル法で求めるよう書いています。後述する実装例では反復回数50のガウス・ザイデル法を用いました。

各変数が意味するところは以下通り。

は株式価格の期待値

は負債成長率の期待値

は株式(自己)資本総額(株価

発行済み株式数)

は資産価値

は負債価値

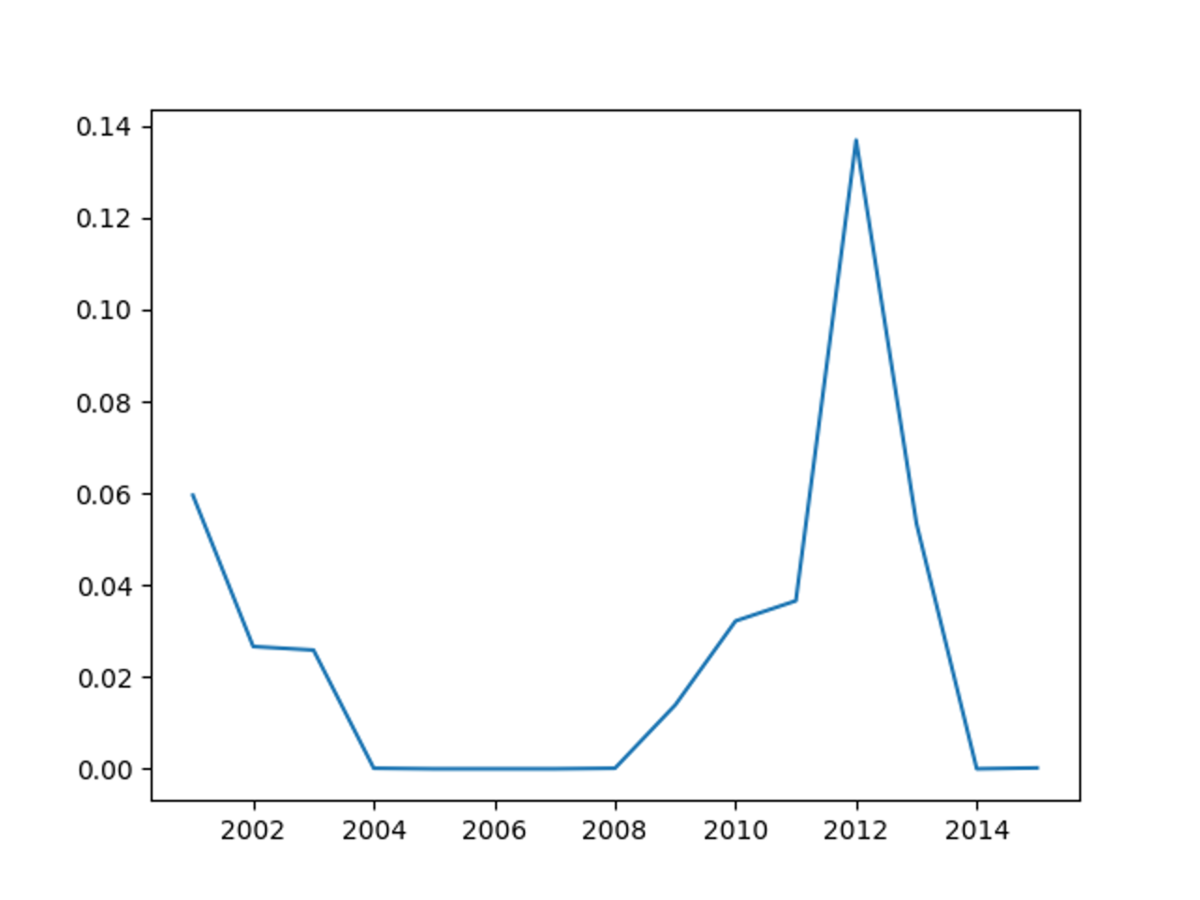

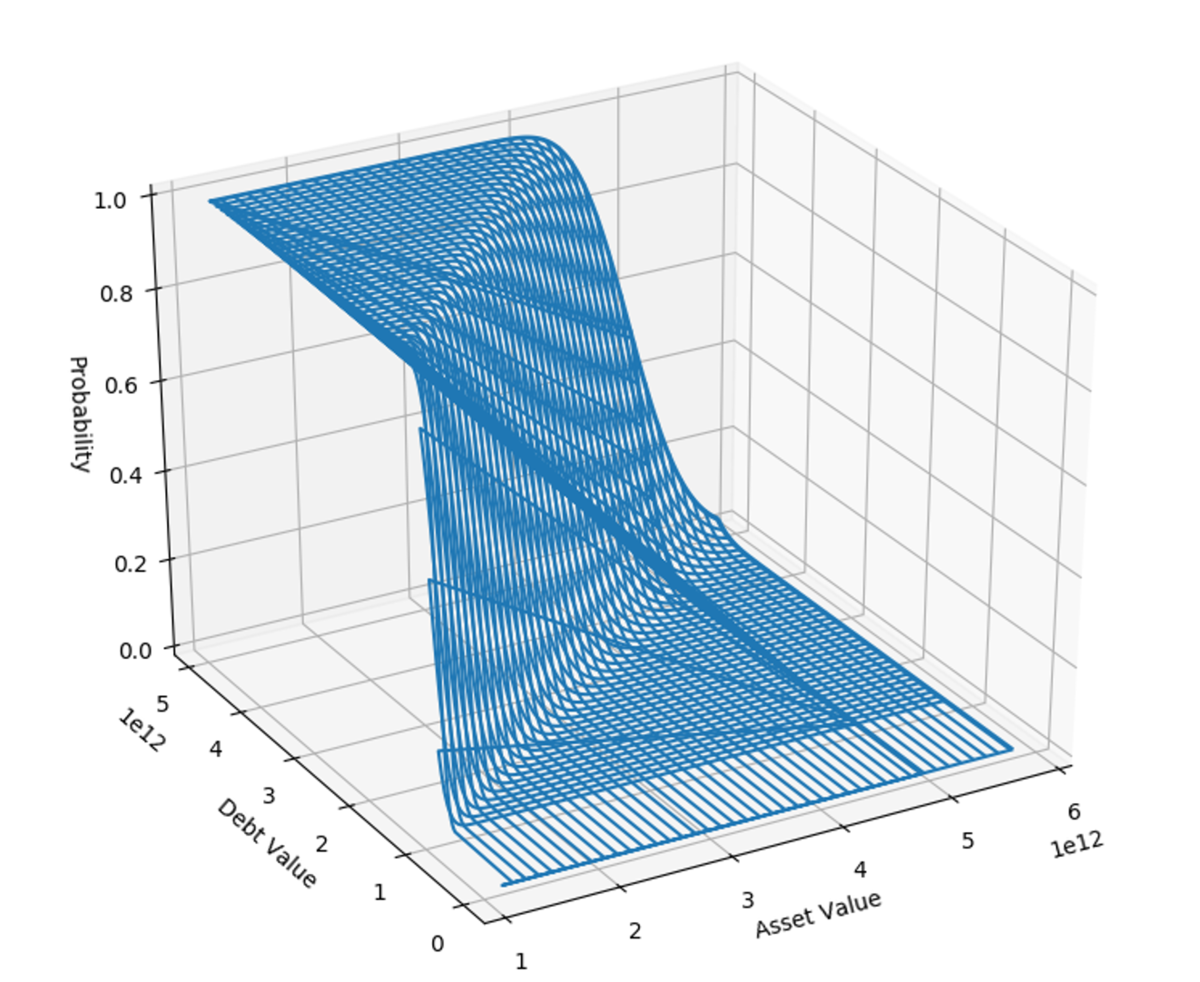

1994年から2016年までのシャープの推計を行うと以下の1枚目の画像のようになりました。実装例には含めていませんが、ある程度の幅をとってシミュレーションした結果が2枚目の画像です。

シャープの財務データを使ったPythonの実装例は以下です。1994年から2016年の各変数に必要な財務データを有価証券報告書から見つけて、おそらく手作業になるけど、csvファイルにすると使えるはず。(あるいは所属大学や組織の商用データベースで。)

#This code calucurating 'Option-based Bunkruptcy risk' from time t to T=1. #'T = 1' means 1 year later from time t. #The Expected growth-rate of asset(= marketcapitalization) debt #are calucurated with datas for last five years. #Through the process below, calucurating the parameters; mu_A, sigma_A, A_t. #Other parameters are given; E_t, sigma_E, mu_E, mu_D, D_T, T. #The process uses Gauss-Seidel method. #Company: SHARP import pandas as pd import numpy as np from scipy.stats import norm import math import matplotlib.pyplot as plt #Reading time-series data of debt and equity and maeket capitalization #as Dataframe of Pandas sharp_debt_pd = pd.read_csv('シャープの負債額csvの絶対パス', header = None) sharp_equity_marketcap_pd = pd.read_csv('シャープの株式資本総額csvの絶対パス', header = None) #Chaging datatypes of number as 'float' sharp_debt_pd[2] = sharp_debt_pd[2].astype(float) #Debt is given from the company's B/S, #so the number of figure should be fixed. sharp_debt_pd[2] = sharp_debt_pd[2] * 1000000 print('Debt of sharp 1994-2016') print(sharp_debt_pd) print('-------------------------') sharp_equity_marketcap_pd[1] = sharp_equity_marketcap_pd[1].astype(float) sharp_equity_marketcap_pd[2] = sharp_equity_marketcap_pd[2].astype(float) print('Market capitalization (=0) and equity price (=1) 1994-2016') print(sharp_equity_marketcap_pd) print('-------------------------') #Calucurating change rates per yaer #Changing the names of Dataframes #Be careful of not forgetting first line would be NaN #on 'changes_..._pd' changes_debt_pd = pd.DataFrame() changes_equity_marketcap_pd = pd.DataFrame() changes_debt_pd[0] = sharp_debt_pd[2].pct_change() changes_equity_marketcap_pd[0] = sharp_equity_marketcap_pd[1].pct_change() changes_equity_marketcap_pd[1] = sharp_equity_marketcap_pd[2].pct_change() final_result = list() print('Changes of debt') print(changes_debt_pd) print('-------------------------') print('Changes of market capitalization (=0) and equity price (=1)') print(changes_equity_marketcap_pd) print('-------------------------') #Defining parameters gotten given from the time-series data upper at t. for t in range(8,23): #'iloc' should be chosen to specify component of dataframe with number. #There is a explaination for it in Japanses. # https://yolo.love/pandas/loc-iloc-at-iat/ #E_t is the market capitalaization at time t. E_t = sharp_equity_marketcap_pd.iloc[t, 1] #Calucurating a sigma of equity for last 5 years. sigma_E = changes_equity_marketcap_pd.iloc[t-5:t, 1].std() #Calucurating a mu of equity price change for last 5 years. mu_E = changes_equity_marketcap_pd.iloc[t-5:t, 1].mean() #Calucurating a mu of debt change for last 5 years. mu_D = changes_debt_pd.iloc[t-5:t, 0].mean() #D_T is amount of debt after 1 year. #[let a debt on book (at t = T) be regard as effectivness for 1 year] D_T = sharp_debt_pd.iloc[t, 2] #T=1 means measuring a risk of bankruptcy of 1 years later. T = 1 print('E_t is ' + str(E_t)) print('sigma_E is ' + str(sigma_E)) print('mu_E is '+ str(mu_E)) print('mu_D is ' + str(mu_D)) print('D_T is ' + str(D_T)) #Creating equation based Gauss-Seidel method # with the parameters defined upper. #Number of times of roop to get convergence value(=answer at t) is n. #First, initial value should be created. #The initial values are be calucurated with historical data to #avoid a result of error caused by limitations. n = 50 mu_A = np.array([0.25493648]) sigma_A = np.array([1.24735172]) A_t= np.array([1.348580e+12]) #Creating a empty pd.DataFrame to show final results at each t. final_results = pd.DataFrame() #roop start for k in range(0,n+1): d_1 = (np.log(A_t[k] / D_T) + (mu_A[k] + (sigma_A[k])**2/2 ) * T) / (sigma_A[k] * np.sqrt(T)) sigma_A_ = sigma_E * E_t / (A_t[k] * norm.cdf(x=d_1, loc=0.5, scale=1) ) sigma_A = np.append(sigma_A, sigma_A_) d_2 = d_1 - sigma_A[k+1] * np.sqrt(T) A_t_ = (E_t + D_T * norm.cdf(x=d_2, loc=0.5, scale=1)) / norm.cdf(x=d_1, loc=0.5, scale=1) A_t = np.append(A_t, A_t_) mu_A_ = (E_t/A_t[k+1]) * mu_E + (1 - E_t/A_t[k+1]) * mu_D mu_A =np.append(mu_A, mu_A_) print(sigma_A[n]) print(A_t[n]) print(mu_A[n]) d = (np.log(A_t[n] / D_T) + (mu_A[n] + (sigma_A[n])**2/2 ) * T) / (sigma_A[n] * np.sqrt(T)) bankruptcy_risk_t = 1 - norm.cdf(x=d, loc=0.5, scale=1) print(d) print(bankruptcy_risk_t) final_result.append(bankruptcy_risk_t) print(final_result) y = final_result x = list(range(2001, 2016)) plt.plot(x, y) plt.show()

*1:森平爽一郎(2000)「信用リスクの測定と制御」計測と制御. (2.3 オプション・アプローチ)信用リスクの測定と制御